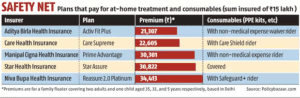

Safety net: Covid-19 cases up, check if policy covers at-home care

Sum insured must be adequate, include consumables like PPE kits – The resurgence of Covid-19 has reignited fears of infection and the financial burden of medical treatment. The importance of assessing one’s health insurance policy covers and financial preparedness can’t be overstated.

Inadequate coverage – The previous waves offer a few lessons. “Medical costs tend to shoot up in a crisis. During Covid, hospitalisation was two-three times more expensive than normal. The frequency of hospitalisation also rose,” says Kapil Mehta, co-founder, SecureNow. Many either did not have health insurance or had policies with insufficient sum insured, which was inadequate to meet the expenses of multiple hospitalisations.