The regulator has asked companies to disclose the discounts they can offer on direct purchases since they involve no commission. Direct modes exist even now. All that IRDAI has now mandated is a bit more transparency. That doesn’t mean insurers and policyholders are mandated to offer direct plans, unlike MFs

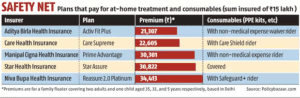

Some insurers have been offering direct plan-like insurance policies on their websites, with lower premiums.

The Insurance Regulatory and Development Authority of India (IRDAI) has asked insurers recently to disclose to policyholders the probable discounts on premiums, if those policy sales do not involve agents, and, therefore, commissions.

Since no commission is to be paid, the savings on such policies, available directly on an insurance company’s website, can be passed on to policyholders as lower premiums.

“Every insurer shall have a well-documented policy approved by its board on an annual basis, which shall, at the minimum, specify the measures to bring cost-effectiveness in the conduct of business and reduction of expenses of management (EoM) on an annual basis, manner of transfer of benefits arising from reduction of expenses and/or from directly sourced business to the policyholders by way of reduction in premium,” says IRDAI’s notification on EoM caps for life, general and health insurance companies.

Also read | Beyond health cover: How employers can widen their insurance bouquet for employees

A direct mutual fund plan moment?

To be clear, IRDAI has merely mandated a bit more transparency on insurance companies. This does not mean that they have to mandatorily offer direct plans or policies to policyholders.

Mutual funds (MF) are mandated to offer direct plans to unit holders. These plans are called direct plans and do not come embedded with distributor commission, unlike the regular plans. The difference between the expense ratio of a direct MF plan and a regular plan is a distributor’s commission.

Investors, who buy plans directly from a fund house’s branch or from its website, can save on distributor’s commission.

Insurance companies, on the other hand, are not mandated to offer direct plans. However some insurers like Acko General Insurance and Aegon Life Insurance have been offering direct plan-like insurance policies on their websites, with lower premiums.

IRDAI’s latest notifications take a small step forward. Now, insurers who offer such direct policies must state the quantum of discounts they offer, clearly in their board-approved policies. The quantum of discounts, though, has been left entirely to insurance companies.

Besides, even the commission and EoM structure in force until March 31, 2023, did not prevent companies from charging lower premiums to policyholders buying policies directly.

“The circular does not make any specific mention of direct plans. Technically, insurers could pay lower commissions and pass on the benefit to policyholders even when commission caps existed (the new rules effective April 1 allow insurers to pay commissions as per board-approved policies, while adhering to the overall EoM ceilings. It is up to the life insurers to decide how or whether to offer differential pricing),” says Kamlesh Rao, MD and CEO, Aditya Birla Life Insurance.

The new payment of commission and EoM rules, effective April 1, have mandated insurers to specify board-approved policies on commissions, clearly. They include any reduction in premium benefit that can be passed on to policyholders.

Also read | A health insurance policy that locks your premiums till you make a claim

Move unlikely to herald changes in the distributor-reliant industry

However, insurance is still a push-product in India. Even today, companies rely heavily on agents to sell policies. Any move to cut costs here and pass on the savings to policyholders, experts say, can upset the agents’ lobby.

“If I were to offer lower premiums on commission-free, direct products, my distributors are bound to demand the same pricing while keeping the commission payout intact, which will be difficult. This is what has prevented life insurance companies from offering lower premiums on direct policies so far,” says the CEO of a leading private life insurance company who spoke on condition of anonymity.

This will continue to be the case unless IRDAI issues an unambiguous diktat mandating differential pricing for direct and distributor-sourced policies, he adds.

Companies like Acko General Insurance and Aegon Life Insurance have promoted their direct models as their USPs and all insurance companies, including the Life Insurance Corporation of India (LIC), sell policies through direct and online modes.

“Every company is free to offer differential pricing, but the challenge for most companies is that they operate with agents. So, those distribution channels are bound to object if they offer discounts on policies sold through, say, online channels,” explains Animesh Das, Chief Underwriting Officer, Acko General Insurance.

“Every company understands that there is a saving for the customer. It depends on the provisions in the product filed. If the company decides to offer a 30 percent discount while selling online, it can (which was the case even prior to the new EoM rules).”

Then, there are industry players who believe that IRDAI’s rules will pave the way for savings, if any, to be passed on to all policyholders, not just direct customers, and over a period of time.

“The clause has to be read in conjunction with the first one, which says that insurers have to review their EoM every year and strive to bring them down annually. So, if you (insurers) source the policy directly and it leads to a reduction in cost, it should be passed on to policyholders. However, it is a broad guideline. The reduction in premium could be passed at the portfolio level to all policyholders and not restricted only to those who buy directly,” says Abhishek Bondia, Managing Director and Principal Officer, SecureNow Insurance Brokers.

A nudge to insurers

While rules did not prevent insurance companies from offering discounts to policyholders reaching out through direct channels, IRDAI’s latest notification could act as the much-needed nudge towards passing on the savings on commissions to policyholders.

Overall, IRDAI’s move is positive as it will act as a guide to companies to reach out to customers directly. It is more like a guidance as not all companies are utilising it (the existing flexibility to offer discounts), while some companies, like ours, were already making use of it. It will be beneficial to customers as the direct route is a transparent, cheaper one,” says Das.

However, others believe direct route does not automatically translate into savings for insurers. “Even to sell policies through the direct mode, the insurer will have to incur advertising and sales expenses, which the intermediary would have borne. Then, there is claim servicing, which, otherwise, the agent would take care of,” says Hari Radhakrishnan, Regional Director, First Policy Insurance Brokers.

The quantum of discounts, too, will be a critical factor in determining whether policyholders make a switch to low-commission policies. “The objective of the government and the IRDAI is to encourage insurance penetration and there is a feeling that higher pricing (due to higher commissions) is one of the barriers. However, the under-penetration is not due to the price points. It is because people see insurance as merely an expense and do not appreciate the value it can add. Now, insurance companies can start direct verticals, but this, too, involves costs. If they offer discounts of just 5-6 percent, policyholders might still prefer agents as insurance is a complex product that necessitates hand-holding,” says Rahul Mishra, Co-founder and Director, PolicyEnsure, an insurance broking firm.

Put simply, it remains to be seen if insurers take a cue from IRDAI’s nudge to move to offer worthwhile discounts on policies purchased through online and direct platforms.