Category: PR & News Update

World Heart Day 2023: 4 Start-ups Making An Impact

World Heart Day is celebrated by organizing various activities and awareness events globally to raise awareness about heart disease and its preventive measures to manage cardiovascular diseases. Here are 4 startups working towards making a difference.

The day is celebrated by organizing various activities and awareness events globally to raise awareness about heart disease and its preventive measures to manage cardiovascular diseases. The events mainly focus on educating people about the signs and symptoms of cardiovascular disease to avoid any further complications and encouraging people to inculcate a healthy lifestyle to prevent and control any heart-related ailments.

The heart is one of the vital organs of the human body, malfunctioning of it may lead to fatality, so everyone needs to take care of heart health. Due to a lack of awareness about cardiovascular health and certain lifestyle habits, cardiovascular diseases (CVDs) is one of the leading reason for mortality worldwide. Every year, around 1.7 crores people die due to cardiovascular disease, accounting approx 31% of all global mortality.

Heart attack, Stroke and coronary heart disease are some of the most common reasons of death due to cardiovascular disorders. These heart disorders account for nearly 85% of total deaths due to cardiovascular ailments. World Heart Day plays a vital role in creating awareness to educate people across the world to understand the importance of heart health and bringing other organizations together to actively participate in organizing various events to create awareness. Here are 4 startups working towards making a difference.

1. Policy Ensure

Policy Ensure promotes heart-healthy lifestyles by offering health insurance policies that incentivize regular health check-ups, provide coverage for preventive care, and offer discounts on fitness memberships. Rahul M Mishra, Co-Founder and Director, of Policy Ensure shared, “Our educational resources emphasize the importance of exercise, balanced diets, and stress management for overall heart health.” Mental health support and preventive care for chronic diseases often receive insufficient attention in healthcare. “Healthcare disparities in underserved communities need addressing to ensure equitable access to quality care,” he added.

2. Kapiva

Dr Kriti Soni, Head of R&D at Kapiva explained, “At the core of Kapiva, we are committed to catering to overall health and wellness including heart health. We offer products featuring heart-healthy herbs and Ayurveda-approved supplements and endorse stress-reducing practices like yoga and meditation. These holistic approaches align with Ayurvedic principles to empower individuals to achieve lasting heart wellness through balanced living”. She further added, “Many aspects of healthcare tend to be overlooked by the general public. These often neglected areas encompass mental health, preventive care, the management of chronic diseases, and the consideration of social determinants of health. For example, herbs like Ashwagandha help keep stress levels in check, or Cinnamon to keep blood lipid levels like LDL cholesterol in control.” “The goal is to control blood pressure for optimal heart health through Ayurvedic solutions,” she said.

3. KITES Senior Care

Dr Reema Nadiq the Co-Founder and Group Medical Director explained, “We prioritize heart health of our elderly. We promote active and healthy lifestyles in our retirement homes and also at their residences, emphasizing physical and mental well-being, which plays a vital role in heart health as we age.” Parallelly they will soon be launching a remote health tech platform. This innovative solution will enable us to closely monitor the heart health of active seniors, providing real-time support and interventions to ensure their continued well-being and a healthier, happier life.

4. Dozee

CEO and Co-founder, Mudit Dandwate shared, “There is a growing need for the continuous monitoring of cardiac health to prevent cardiovascular diseases and sudden heart failures and heart attacks. Taking into account the fact that undetected cardiac anomalies might fatally affect patients, the utilization of AI-based continuous monitoring technology can enable healthcare providers with early detection and timely intervention.” To that end, Dozee’s AI-based remote patient monitoring (RPM) and early warning system (EWS), developed with the usage of 150-year-old Ballistocardiography (BCG) technology can efficiently monitor the cardiac activity of individuals with clinical grade precision and accuracy. By continuously tracking parameters such as blood pressure, heart rate/pulse rate, SpO2, respiration rate and temperature, we offer a comprehensive solution for continuous cardiac health monitoring, allowing healthcare providers to intervene timely and prevent cardiovascular diseases, sudden heart failures, and heart attacks.

Health Insurance: डायबिटीज और बीपी के रोगी अपनाएं ये तरीके, कम प्रीमियम पर मिलेगा स्वास्थ्य बीमा

Health Insurance for Diabetes and BP patient अगर कोई डायबिटीज और बीपी का रोगी सस्ती दर पर हेल्थ इंश्योरेंस लेना चाहता है तो उसे अपनी जीवनशैली में बदलाव करना होगा। इसके साथ बीमा कराते समय रिसर्च और नो क्लेम बोनस का फायदा लेकर भी डायबिटीज और बीपी का रोगी कम प्रीमियम पर हेल्थ इंश्योरेंस पॉलिसी ले सकता है।

नई दिल्ली, बिजनेस डेस्क। डायबिटीज और बीपी के रोगियों के लिए स्वास्थ्य बीमा आम लोगों के मुकाबले काफी महंगा होता है। एक्पर्ट्स बताते हैं कि अगर सही तरीके अपनाएं जाए तो डायबिटीज और बीपी रोगियों को भी स्वास्थ्य बीमा किफायती दरों पर मिलता है।

बीमा क्षेत्र में काम करने वाली कंपनी पॉलिसी एनश्योर के सह-संस्थापक और निदेशक, राहुल एम मिश्रा का कहना है कि अगर कोई डायबिटीज और बीपी से ग्रस्ति व्यक्ति कम दर पर स्वास्थ्य बीमा चाहता है तो उसको कुछ तरीकों को जरूर अपनाना चाहिए।

1.नियमित स्वास्थ्य जांच: बीमा कंपनियों को अपनी नियमित रूप से अपनी जांच रिपोर्ट और स्वास्थ्य स्थिति प्रदर्शित करनी चाहिए। साथ ही आपको अपनी जांच रिपोर्ट्स का पूरा रिकॉर्ड रखना चाहिए।

2. तुलनात्मक खरीदारी: आपकी आवश्यकताओं और बजट के लिए सबसे उपयुक्त बीमा पॉलिसी खोजने के लिए विभिन्न बीमाकर्ताओं की स्वास्थ्य बीमा पॉलिसियों पर रिसर्च करें और उनकी तुलना करें।

3.विशिष्ट योजनाएं: विशेष रूप से पहले से मौजूद बीमारियों वाले व्यक्तियों के लिए डिजाइन की गई स्वास्थ्य बीमा योजनाओं की तलाश करें। कुछ बीमाकर्ता डायबिटीज और बीपी की विशिष्ट योजनाएं पेश करते हैं।

4.समूह बीमा: यदि आप कार्यरत हैं, तो जांचें कि क्या आपका नियोक्ता समूह स्वास्थ्य बीमा प्रदान करता है। ये पॉलिसियां अक्सर बेहतर कवरेज और कम प्रीमियम प्रदान करती हैं।

5.जीवनशैली में बदलाव: स्वस्थ जीवनशैली में बदलाव करना जैसे कि अपना वजन नियंत्रित करना और नियमित व्यायाम करना। आपकी हेल्थ पॉलिसी का प्रीमियम कम करने में मदद कर सकता है।

6.नो क्लेम बोनस: ऐसी पॉलिसियां चुनें जो नो क्लेम बोनस (एनसीबी) प्रदान करती हैं। आप प्रत्येक दावा-मुक्त वर्ष के लिए sum insured enhancement अर्जित कर सकते हैं।

7.सरकारी योजनाएं: आयुष्मान भारत जैसी सरकार प्रायोजित स्वास्थ्य बीमा योजनाओं का पता लगाएं, जो पहले से मौजूद कुछ स्थितियों के लिए कवरेज प्रदान कर सकती हैं।

8.बीमा सलाहाकार: बीमा सलाहाकार से परामर्श करने पर विचार करें जो आपकी विशिष्ट स्वास्थ्य आवश्यकताओं के अनुरूप सबसे अधिक लागत प्रभावी पॉलिसी ढूंढने में आपकी सहायता कर सकता है।

स्टार हेल्थ मधुमेह सुरक्षित बीमा: विशेष रूप से मधुमेह रोगियों के लिए डिजाइन किया गया, यह मधुमेह से उत्पन्न होने वाली जटिलताओं को कवर करता है।

एचडीएफसी एर्गो स्वास्थ्य सुरक्षा गोल्ड: व्यापक कवरेज प्रदान करता है और इसमें प्रतीक्षा अवधि के बाद पहले से मौजूद स्थितियों के लिए कवरेज शामिल है।

मैक्स बूपा हेल्थ कंपेनियन: आजीवन नवीकरणीयता प्रदान करता है और प्रतीक्षा अवधि के बाद पहले से मौजूद स्थितियों को कवर करता है।

अपोलो म्यूनिख ऑप्टिमा रिस्टोर: यदि पॉलिसी वर्ष के दौरान बीमा राशि समाप्त हो जाती है तो उसे बहाल करने की एक अनूठी सुविधा प्रदान करता है।

न्यू इंडिया एश्योरेंस मेडिक्लेम पॉलिसी: पहले से मौजूद स्थितियों के लिए कवरेज वाली पॉलिसी प्रदान करती है, हालांकि प्रतीक्षा अवधि लागू हो सकती है।

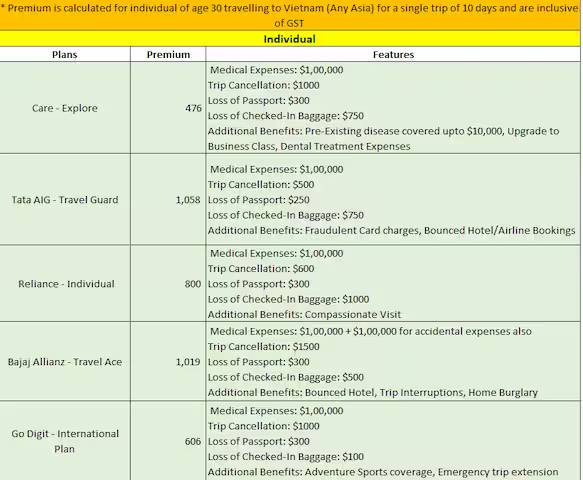

1/4th buy travel insurance 30 days prior to trip: How to pick the right one

Only 25 per cent of Indians going abroad buy travel insurance well in advance while making travel arrangements; a large majority wait until the last 3 days to buy it, according to a survey conducted by Policybazaar.

While people nowadays understand the importance of buying travel insurance, they are still not aware of the lesser-known benefits of buying one, besides coverage for baggage loss, flight cancellation and medical emergencies. This could also be because, predominantly, a major chunk of Indian travellers go to Asian countries, and they don’t need to present their policy copy until the day of the trip.

As of July 2023, over 38 per cent of the people travelling abroad planned their trip for more than 15 days, mostly for European countries, followed by 26 per cent planning to stay for 7-10 days.

Seven out of 10 people understand the importance of having an adequate sum insured while travelling abroad, choosing over $100,000 as sum insured. The rest of them choose almost half of it, which is the minimum coverage you can opt for, according to the survey.

The trend of vacationing abroad has reached the pre-pandemic level, with over 97 per cent of people currently travelling outside the country for leisure. Thailand continues to be the most preferred Asian travel destination for Indians. Vietnam and Indonesia are also emerging as hot travel destinations after the pandemic.

“Just like you plan your accommodation, flights and itinerary, deciding on a comprehensive travel insurance policy that can protect and safeguard you against common travel inconveniences is essential, allowing you to peacefully enjoy your trip with family. Before buying a travel insurance policy, you must check all the inclusions and exclusions carefully. You must ensure that the most common and basic benefits like coverage for Covid-19, medical emergencies, trip cancellation and curtailment, baggage loss and passport theft, etc, are covered under your policy,” said Manas Kapoor, Product Head – Travel Insurance, Policybazaar.com.

Some other popular benefits that travellers should opt for are coverage for pre-existing diseases or illnesses, OPD coverage, trip extensions, personal accident cover, home burglary insurance and multi-trip insurance or frequent flyers plan. Policybazaar has curated a list of travel insurance policies available for overseas trips to Asia that you can opt for

How to choose the right travel insurance policy when travelling overseas:

Rahul Meena Mishra, co-founder & director, Policy Ensure, explains how to choose and decide on your travel policy:

• Assess your needs: Consider your travel destination, duration, and activities you plan to engage in. Determine the level of coverage you require for medical emergencies, trip cancellation or interruption, baggage loss, and personal liability.

• Check coverage limits: Review the coverage limits provided by different insurance policies. Ensure they meet your specific requirements, especially for medical expenses, emergency medical evacuation, and trip cancellation costs.

• Understand exclusions: Read the policy exclusions carefully. Be aware of situations or activities that may not be covered, such as pre-existing medical conditions, adventure sports, or acts of terrorism. If you need coverage for any excluded items, look for policies that offer optional add-ons or specialised coverage.

• Medical coverage: Pay close attention to the medical coverage offered by the policy. Check if it includes emergency medical treatment, hospitalisation, ambulance services, and repatriation of remains. Ensure the coverage limits are sufficient for the destination you’re visiting, as healthcare costs can vary widely across countries.

• Trip cancellation and interruption: If your trip is expensive or involves non-refundable bookings, consider a policy that provides comprehensive trip cancellation and interruption coverage. This will protect you financially in case unforeseen circumstances force you to cancel or cut short your trip.

• Baggage and personal belongings: Look for a policy that offers coverage for lost, stolen, or damaged baggage and personal belongings. Check the coverage limits and any sub-limits for valuable items like electronics or jewellery. Also, verify if the policy covers delayed baggage and provides reimbursement for essential items during the delay

• Compare prices and reviews: Obtain quotes from multiple insurance providers and compare the prices against the coverage offered. However, remember that the cheapest policy may not always provide the best coverage or customer service. Read reviews and ratings of the insurance company to gauge its reputation and customer satisfaction level.

• Pre-existing medical conditions: If you have pre-existing medical conditions, ensure that the policy covers them or offers a waiver for pre-existing conditions. Some policies may require you to declare your medical conditions upfront or undergo a medical examination.

• Travel assistance services: Consider the additional services provided by the insurance company, such as 24×7 emergency assistance, travel concierge services, or language translation support. These can be valuable during emergencies or if you need assistance while travelling.

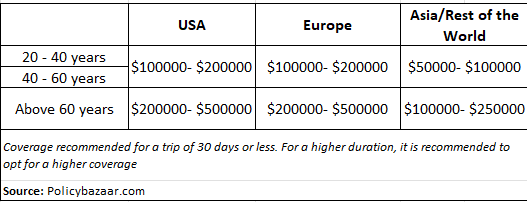

What’s the ideal option and cover? Overview of the right coverage based on age and destination, according to policybazaar:

Destination-specific coverage: Different countries may have unique risks and healthcare systems. Research the healthcare facilities, quality of care, and associated costs in the countries you intend to visit.

Schengen Visa requirements: If you’re travelling to Schengen countries in Europe, it is mandatory to buy travel insurance that meets the minimum coverage requirements (30,000 euros) specified by the Schengen visa authorities. Make sure your chosen policy fulfils these requirements to avoid any issues with your visa application.

High-cost destinations: Some countries, such as the United States, Canada, or countries in Western Europe, have higher healthcare costs. If you plan to visit these destinations, ensure your travel insurance policy offers sufficient coverage for medical expenses to avoid potential financial burdens.

Adventure sports and activities: If you’re planning to engage in adventure sports or activities like skiing, scuba diving, or bungee jumping, check if your policy covers such activities. Some policies may have exclusions or require additional coverage for high-risk activities.

Political unrest and natural disasters: If you’re travelling to regions with a history of political unrest or natural disasters, consider a policy that includes coverage for trip cancellation, trip interruption, or evacuation due to these unforeseen events.

Duration of travel: If you’re a frequent traveller or planning a long-term trip, look for policies that offer coverage for extended periods. Some policies may have limitations on the maximum duration of coverage, so choose one that aligns with your travel plans.

Family coverage: If you’re travelling with family members, especially children or elderly individuals, ensure the policy provides suitable coverage for their specific needs. This may include coverage for pediatric care, pre-existing conditions, or medical evacuation for older travellers.

Policy extensions and renewals: If you’re planning to extend your trip or have flexible travel plans, check if your insurance policy allows for extensions or renewals while you’re abroad. It’s important to have continuous coverage throughout your entire trip.

“To maximise the protection, ensure coverage for checked-in baggage loss, trip delay/cancellation, and loss of passport. An emergency cash assistance feature in the policy can be useful if you are mugged or robbed on foreign soil and left without travel funds. It will also be prudent to have a personal liability feature that covers legal liability to a third party resulting in injury, damage to property, and even death, during your trip,” said Rakesh Jain, CEO of Reliance General Insurance.

Health and Lifestyle: How can these two factors impact your life insurance premium?

When it comes to obtaining life insurance, there’s no one-size-fits-all approach to determining premiums. Insurance companies consider a multitude of factors to assess an individual’s risk profile, ensuring that the coverage offered aligns with the potential risks involved. Among these factors, health and lifestyle play a crucial role in shaping the cost of life insurance premiums. Let’s delve into how these factors can impact your life insurance premiums.

Health factor

Your medical history is a key determinant in the calculation of life insurance premiums. Pre-existing conditions such as diabetes, hypertension, heart disease, and cancer can lead to higher premiums due to the increased risk they pose. Insurance providers meticulously assess these conditions to gauge the potential impact on your lifespan and overall health.

Another health-related metric considered is Body Mass Index (BMI). A higher BMI often indicates health risks, which can result in elevated premiums. This is because obesity is associated with various health issues, including cardiovascular diseases and diabetes.

Tobacco and alcohol use are significant contributors to health risks. If you’re a regular tobacco user or engage in excessive alcohol consumption, you’re likely to face higher premiums due to the heightened likelihood of associated health complications.

Moreover, your family medical history is assessed to determine any genetic predispositions to certain illnesses. If your family has a history of conditions like heart disease or cancer, insurers might adjust premiums to reflect the increased likelihood of these conditions affecting you.

Undergoing medical tests is common during the application process. The results provide insurers with an objective assessment of your health status, which in turn influences premium calculations. Positive test outcomes may lead to more favourable premiums while concerning results might result in higher costs.

Lifestyle factor

Your lifestyle also significantly impacts life insurance premiums. Certain occupations entail higher risks due to exposure to hazardous environments or physical demands. Jobs in industries like mining, construction, aviation, and offshore drilling are often deemed higher risk, potentially leading to elevated premiums.

Engaging in high-risk hobbies and activities like extreme sports or adventure pursuits can increase premiums. These activities raise the likelihood of accidents or injuries, which insurance companies take into account when calculating risk.

Frequent travel to regions with health risks, political instability, or high crime rates might influence premiums. Travelling to areas with prevalent diseases can also impact the cost of insurance due to the associated health risks.

Your driving behaviour matters too. A history of accidents, traffic violations, or reckless driving can lead to higher premiums, as it indicates a higher likelihood of premature death or injury.

Financial stability is also considered. Insurers often view a stable financial position as an indicator of responsibility, potentially resulting in more favourable premium rates.

Substance abuse, including tobacco, alcohol, and recreational drugs, can significantly raise premiums due to the health risks associated with these habits.

While not directly factored into premium calculations, maintaining a healthy diet and lifestyle can contribute to better overall health. This healthier profile might result in more competitive premiums.

Stress levels can indirectly impact health. High-stress professions or lifestyles might lead to various health issues. Managing stress through relaxation techniques can positively affect premiums.

Consistent lack of sleep or sleep disorders might lead to health complications, potentially influencing premium calculations.

A history of mental health disorders might influence premiums, especially if they impact life expectancy or overall health.

Safety precautions in daily life, such as wearing seat belts and helmets, can demonstrate responsible behaviour, potentially impacting premiums positively.

Some insurers offer incentives for regular health screenings or wellness programs, which can lead to discounts on premiums. Maintaining a healthy weight through exercise and proper diet can contribute to better health and potentially lower premiums.

It’s crucial to provide accurate information during the application process, as the impact of health and lifestyle factors on premiums can vary between insurance companies. Working with an experienced insurance advisor can guide you through the process and help you find the most suitable coverage at an affordable cost.

Remember, the goal of life insurance is to provide financial security for your loved ones, and understanding how these factors influence premiums can help you make informed decisions about your coverage.

Comprehensive Vs Third-Party Motor Insurance: Coverage, Cost & Considerations

When it comes to insuring your vehicle, it’s essential to choose the right type of motor insurance that suits your needs and offers adequate protection. In most countries, there are two primary options: comprehensive motor insurance and third-party motor insurance. Each type has its advantages and drawbacks, and understanding the differences between them is crucial for making an informed decision. This article aims to compare comprehensive and third-party motor insurance in terms of coverage, cost, and important considerations to help you choose the most suitable policy for your vehicle.

Coverage

Comprehensive Motor Insurance:

Comprehensive motor insurance, as the name suggests, offers extensive coverage for various scenarios. It not only includes third-party liability coverage but also covers damages to your own vehicle. In the event of an accident, theft, fire, or natural disasters like floods or storms, this type of insurance will reimburse you for repairs or replacement of your vehicle. Moreover, comprehensive insurance usually covers personal accident benefits for the driver and passengers, medical expenses, and legal liabilities arising from accidents.

Third-Party Motor Insurance:

Third-party motor insurance, on the other hand, provides coverage only for liabilities towards third parties involved in an accident caused by the insured driver. This includes compensation for injury or death of third parties and damage to their property. However, third-party insurance does not cover any damages to your own vehicle. It is the most basic form of auto insurance mandated by law in many countries.

Cost

Comprehensive Motor Insurance:

Comprehensive motor insurance typically comes with a higher premium compared to third-party insurance due to its wider coverage. The premium amount depends on various factors such as the vehicle’s make and model, the driver’s age and experience, previous claim history, and the location where the vehicle is primarily used or parked. While the upfront cost may be higher, the additional protection and peace of mind make it a preferred choice for many vehicle owners.

Third-Party Motor Insurance:

Third-party motor insurance is generally more affordable as it covers a limited scope of risks. While it provides the necessary legal coverage, it might not be sufficient for those seeking greater protection for their own vehicle.

Considerations

Vehicle Value and Age:

The value and age of your vehicle play a significant role in deciding the type of insurance you should opt for. If you own a brand-new, expensive car, comprehensive motor insurance would be a wise investment to safeguard your substantial financial outlay. On the other hand, if you own an older vehicle with a lower market value, third-party insurance might suffice.

Personal Financial Situation:

Your personal financial situation should also be considered when choosing insurance. If you can afford a higher premium and want comprehensive coverage, it could save you from significant financial burdens in case of accidents or damages. However, if you have budget constraints, third-party insurance might be the more viable option.

Driving Habits and Location:

Assess your driving habits and the environment in which you drive regularly. If you frequently commute in heavy traffic or live in an area with a high incidence of accidents or thefts, comprehensive insurance could be beneficial. Conversely, if you rarely use your vehicle or drive in low-risk areas, third-party coverage might be sufficient.

Additional Riders and Deductibles:

When choosing comprehensive insurance, consider the additional riders available, such as roadside assistance, zero depreciation, or engine protection. Additionally, check the deductible amount, which is the portion of the claim you’ll have to bear in case of an incident. A higher deductible can lower your premium but might increase your out-of-pocket expenses during a claim.

In conclusion, the choice between comprehensive and third-party motor insurance depends on your individual needs, budget, and risk appetite. Comprehensive vehicle insurance offers broader coverage, including damages to your own vehicle, while third-party insurance provides essential legal coverage for third-party liabilities. Carefully evaluate your vehicle, financial situation, driving habits, and location before making a decision. Ultimately, having any form of auto insurance is essential to protect yourself and others on the road, providing you with the peace of mind that comes with knowing you are financially secure in the event of an unforeseen accident.

Critical illness policy must cover ailments relevant to your family history

Owing to rising pollution levels, sedentary lifestyles, and changing food habits, the incidence of critical illnesses has skyrocketed. Yet, very few people buy a critical illness cover that can offer them protection against these financially ruinous ailments. A study by PolicyX.com found that of every 100 policies purchased on their platform over the past year, only two were critical illness covers (89 were hospitalisation plans, seven were senior citizen plans, and one was an accidental cover).

How do they work?

Critical illness policies cover diseases like cancer, kidney failure, heart attack, coma, stroke, organ transplant, bone marrow transplant, paralysis, major burns, and others listed in the policy.

Says Naval Goel, founder and chief executive officer (CEO), PolicyX, “These policies cover a broad spectrum of life-threatening diseases and pay a lump sum amount if one is detected after the policy has commenced.”

Reasonable premiums

Critical illness policies usually come with a high sum insured, as the cost of treating these illnesses is very high. A Rs 10 lakh cover costs approximately Rs 3,500-5,000, depending on the number of ailments covered.

Two variants of these policies are available. Says Roopam Asthana, CEO and whole-time director, Liberty General Insurance, “First is the bundled plan which covers a range of critical illnesses. Typically, the bundles cover nine, 25, or 43 conditions. Second are the disease-specific policies, which cover one particular condition such as cancer, kidney failure, etc.” Both offer similar benefits.

Compensate for loss of income

The lump-sum payout acts as a replacement for loss of income and can also be utilised for costs that are not covered by a normal health insurance (hospitalisation) cover. Says Rahul M Mishra, co-founder and director of PolicyEnsure. “The receipt of a lump sum allows the policyholder to focus on recovery without worrying about medical expenses.”

Parthanil Ghosh, president, retail business, HDFC ERGO General Insurance Company, points out that that a critical insurance policy offers coverage even if the policyholder avails treatment abroad.

They also offer tax deduction on the premium paid.

Only listed ailments covered

One drawback of these policies is that they only cover the illnesses specified in the policy. Says Mishra, “Many policies have waiting periods before certain illnesses are covered.”

Be aware of exclusions

The exclusions vary from one insurer to another. Says Goel, “Critical illness policies do not cover dental care, cosmetic surgeries, illnesses not listed in the policies, maternity and infertility treatments, critical illness arising due to a congenital disorder, etc.”

A claim under this policy cannot be sought during situations of war or natural calamities like earthquake, tsunami, etc. Says Ghosh, “Claims will be rejected if the insured participates in or is involved in naval, military, or air force operations, racing, diving, aviation, scuba diving, parachuting, hang-gliding, rock climbing, or mountain climbing.”

Points to keep in mind

Review the list of critical ailments covered by the policy and see whether those relevant to your family’s medical history are included. Says Ghosh, “Before deciding the sum insured, assess your current health status and lifestyle habits and then determine an appropriate coverage amount that will be adequate to handle medical expenses, loss of income, and financial obligations during a critical illness.”

Check the total tenure. Says Asthana, “Some insurers put a cap on the maximum age of renewal. Check this particular ceiling before buying a plan.” It is advisable to go with a plan that offers lifelong renewal.

Ghosh suggests checking the claim settlement ratio of the insurer.

These policies come with a survival period condition. Says Bhaskar Nerurkar, head of the health administration team, Bajaj Allianz General Insurance, “The insured needs to survive for a specific number of days after being diagnosed with a listed ailment to make a claim.” The lower this period, the better.

Making a claim under this policy is simple. All a policyholder needs to do is submit the diagnostic reports for the listed ailment.

Finally, Goel suggests that if you have a family history of a critical illness or work in a risky and polluted environment, then you must purchase this plan.

Key features to look for

Go for a policy with minimum waiting period

Also select one with the minimal condition regarding survival after diagnosis

Select a policy that offers lifetime renewal

Some policies allow you to pay the premium for up to three years; some discount is available if you pay for a longer tenure in one go

Many policies offer additional benefits, such as cancer reconstructive surgery, cardiac nursing, dialysis care, physiotherapy, etc. (there may be caps on these benefits)

How much health insurance do you need in your 30s? Know how to choose the right medical insurance policy

Health issues often do not wait to strike till your old age, especially due to modern lifestyle. Even those who are as young as 30 years old often need treatments that require hospitalisation and may make a big dent in their savings. Health insurance comes in handy in such a situation. Moreover, if you buy a health insurance policy early, even with a low premium you can afford high coverage.

But how much health insurance coverage do you need? What are the things to look at while buying health insurance cover when you are in your 30s? ET Wealth Online spoke to a number of experts to find out what will be the ideal health insurance sum assured for those who are in their 30s and how to choose it.

Why do you need to buy a health insurance policy when you are young?

There are several benefits you will get for buying a health insurance policy in your 30s. Firstly, you will get a comprehensive health insurance cover at an affordable price. “As young consumers fall into the bracket of higher immunity and lower risk of contracting several medical conditions like diabetes, hypertension, or critical illnesses such as organ failure, cancer, cardiovascular diseases, etc., they have the advantage of getting higher coverage at a lesser premium,” said Siddharth Singhal, Business Head – Health Insurance, Policybazaar.com.

Further, most health insurance policies have waiting periods for specific treatments or pre-existing conditions. By purchasing health insurance early, you can serve out these waiting periods while you are still healthy, ensuring that coverage is available when you need it in the future, explained Rakesh Goyal, Director, Probus Insurance Broker.

Moreover, it offers you peace of mind. Knowing that you have a financial safety net in place can free you from stress and worry when it comes to managing healthcare costs.

What should be your ideal sum-assured amount?

When buying a health insurance policy, the most important question is how much coverage you should get. The ideal sum assured depends on various factors like lifestyle, income, family size, location, and medical history.

“Consider the potential healthcare costs you may incur in the future. Evaluate the average medical expenses in your region and factor in any specific health concerns or pre-existing conditions. Ensure the sum assured is adequate to cover potential medical bills,” said Goyal.

As a thumb rule, it is recommended to have a sum assured of at least 2 to 3 times your annual income, mentioned Rahul M Mishra, Co-Founder & Director, Policy Ensure.

“For a person staying in a metropolitan city like Delhi or Mumbai, a sum insured of Rs 10 lakh per member is recommended. However, for a family of two adults with one child, the policyholder should opt for Rs 30 lakh of coverage,” said Singhal.

Echoing the same, Pankaj Goenka, Business Head of InsuranceDekho said, the ideal sum assured for a 30-year-old smoker as well as a non-smoker should be around Rs 10 lakh.

| How much a health insurance policy of Rs 10 lakh can cost you at the age of 30 | |||

| Company | Plan | Cover Amount | Annual Premium |

| Care Health Insurance | Care Supreme | Rs 10 Lakh | Rs 8,419 |

| Niva Bupa Health Insurance | ReAssure 2.0 Bronze+ | Rs 10 Lakh | Rs 8,756 |

| Star Health Insurance | Star Comprehensive | Rs 10 Lakh | Rs 11,476 |

| Aditya Birla Capital | Activ Fit Plus | Rs 10 Lakh (+ Rs 10 Lakh extra) | Rs 8,032 |

| HDFC ERGO General Insurance | Optima Secure | Rs 10 Lakh (+ Rs 10 Lakh extra) | Rs 10,443 |

| ManipalCigna Health Insurance | Prime – Advantage | Rs 10 Lakh | Rs 11,522 |

| Reliance General Insurance | Health Gain | Rs 10 Lakh | Rs 6,072 |

| Tata AIG Insurance | Medicare Premier | Rs 10 Lakh | Rs 11,909 |

| Digit Insurance | Infinity Wallet | Rs 10 Lakh | Rs 8,796 |

| Source: PolicyBazaar.com | |||

If affordability is not a concern, you should take a health insurance policy that has a sum assured of more than Rs 10 lakh but not less. As a young person, you would need this health insurance cover for a longer period. Therefore, a higher sum assured will not only help you fight the current cost of treatment but also higher costs in the future due to inflation.

If you live in a metro, the sum assured can be around Rs 20 lakh, said Kapil Mehta, Co-founder, SecureNow Insurance Broker. Explaining two important reasons behind it, Mehta mentioned, “Firstly, many diseases that impact the young, such as cancers, can cost Rs 10 to 15 lakh to treat. Secondly, the insurance you are buying today should have a sum assured that factors in medical inflation and the higher costs expected in the future for treatment.”

“This medical inflation is between 10 per cent and 15 per cent per annum. That is why a higher sum assured of Rs 20 lakh makes the most sense. From a pricing standpoint, the premium difference between a Rs 10 lakh and a Rs 20 lakh cover is not that significant. Both smokers and non-smokers should have a Rs 20 lakh cover,” he added.

| How much a health insurance policy of Rs 20 lakh can cost you at the age of 30 | ||

| Company | Plan | Annual Premium (Rs) |

| ICICI Lombard General Insurance | Health AdvantEdge Apex Plus | 14,202.00 |

| Future Generali Indian Insurance | Health Absolute(Platinum) | 14,217.00 |

| SBI General Insurance | Arogya Supreme Health Insurance | 11,432.00 |

| Star Health Insurance | Star Comprehensive Insurance Policy | 16,638.00 |

| Niva Bupa | Reassure 2.0(Platinum+) | 15,598.00 |

| Aditya Birla Capital | Activ Health Fit | 12,036.0 |

| Reliance General Insurance | HealthGain Insurance | 10,060.68 |

| Oriental Insurance | Arogya Sanjeevani Policy | 11,097.0 |

| HDFC Ergo General Insurance | Optima Secure | 12,779.00 |

| Iffco-Tokio General Insurance | Individual Health Protector Policy | 13,934.62 |

| Royal Sundaram General Insurance | Lifeline Supreme | 9,921.52 |

| Chola MS General Insurance | Flexi Health Supreme(Plus) | 11,237.00 |

| Tata AIG Insurance | Medicare | 14,059.00 |

| Bajaj Allianz | Individual Health Insurance(Gold Plan) | 11,120.32 |

| Manipal Cigna | ProHealth Prime | 13,142.84 |

| Source: SecureNow Insurance Broking Pvt. Ltd. | ||

The data pertains to individual health insurance cover of Rs 20 lakh for 30-year-old (unmarried), non-smoker, residing in a metro, as of August 1, 2023. Data is indicative. Actual premium and information may vary.

Do keep in mind that if we compare the premium for different sums insured, then when we move from Rs 5 lakh to Rs 10 lakh, we get 2X coverage, but the premium increases only 30-40 per cent. Similarly, for Rs 10 lakh to 20 lakh, the premium increases only 20-30 per cent and a similar trend is observed for a higher sum insured, said Goenka.

How to choose your health insurance policy in 30s

As you get a rough idea about how much health insurance coverage you need, let’s find out how to choose your insurance policy. It’s crucial to take into account a number of things while choosing health insurance coverage. “The main factors to consider are product features, claims payment record, and premium,” said Mehta.

To make it easier for you, ET Wealth has listed eight points that you need to keep in mind.

Coverage and benefits:You must look for comprehensive coverage that includes hospitalisation expenses, pre and post-hospitalisation costs, daycare procedures, ambulance charges, and other relevant benefits based on your specific needs, explained Goyal.

Plans with no sub-limits:Ideally, you may choose a health insurance policy that does not have any kind of co-payments and covers expenses like room rent, ICU charges, domiciliary treatment costs, etc. Plans with sub-limits limit the scope of coverage and result in out-of-pocket expenses, explained Singhal.

Network of network hospitals:Your insurer should have a good number of network hospitals so that you can get quality treatment in a cashless manner. The more the number of network hospitals, the more beneficial it is for you as a policyholder, said Goenka.

Waiting period:The waiting period is the time period that you have to wait before you can file a claim on your health insurance policy. Some policies have longer waiting periods than others. So, while buying a health insurance plan , you must check the waiting period as it varies from insurer to insurer.

Flexible coverage:Individual health insurance allows you to select coverage options and add-ons that align with your personal health needs. It provides flexibility in choosing deductibles, coverage for pre-existing conditions, maternity benefits, and other specific requirements, said Goyal.

Claim settlement ratio:The claim settlement ratio refers to the insurer’s efficiency in settling health insurance claims. You should ideally choose a company that has a higher claim settlement ratio.

Customer service:The insurer should have good customer service to answer all your queries. You can check the insurer’s customer service by calling their customer service number or by reading online reviews, said Pankaj Goenka, Business Head Head, InsuranceDekho.

Look for plans with a renewal bonus:Since medical inflation in India is 14 per cent, it is important that your health insurance premium increase every year. Hence, the renewal bonus is an important factor to look at, Goenka added.

Should you opt for critical illness health insurance cover?

Once you have comprehensive medical insurance, you can consider buying a standalone critical illness insurance cover. This policy covers a large number of ailments and you get a fixed amount if diagnosed with a named critical illness. If you have a critical illness in your family history or have a high-risk job then opt for a critical illness or disability rider respectively, said Naval Goel, Founder and CEO, PolicyX.

Some common critical illnesses that often result in significant claims include cancer, heart-related conditions, neurological disorders, kidney diseases, and organ failures.

“If you opt for critical illness cover, carefully review the policy terms and conditions to understand which critical illnesses are covered and the payout structure. Consider factors such as family medical history, lifestyle, and the prevalence of specific illnesses when deciding whether to choose critical illness cover or riders. Additionally, it is crucial to compare the cost of critical illness riders or standalone policies with the benefits they offer. Some individuals may prefer to have a separate critical illness policy to ensure higher coverage amounts, while others may find riders more cost-effective,” said Goyal.

Should you add your family to your health insurance policy?

The 30s could be a time when many people have just started a family or planning to start one in the next few years. When you are purchasing a health insurance plan in your 30s, you need to take into account how you are planning to take care of your family or dependents going forward.

To address the healthcare needs of your family or dependents, you go for a family floater plan where you can add your family members to your health insurance policy. Many insurers allow you to add family members during policy renewal or within a specific timeframe after marriage or childbirth.

Do remember that individual health insurance does not allow you to add dependents. “A family floater plan is cheaper than an individual plan as the sum insured is shared by an entire family,” said Goyal.

“The cost of adding family members depends on the number of individuals, their age, and the sum assured chosen,” said Mishra.

“Insurance companies usually have provisions to add a spouse during the policy term, subject to the payment of an additional premium. Most health insurance policies allow the inclusion of dependent children up to a certain age (usually 18 to 25 years) under the family coverage. Some policies may also have provisions for extended coverage for children pursuing higher education or until they become financially independent,” said Goyal.

When adding family members to the policy, be aware of any waiting periods associated with specific coverage benefits. Some policies may have waiting periods for maternity benefits, pre-existing conditions of family members, or certain illnesses.

Should you add your elderly parents in the same family floater plan?

Now should you add your elderly parents to the family floater plan? When compared to your parents you may need your health insurance policy for a much longer period. At old age parents may need frequent hospitalization which may adversely impact the available sum assure for younger members.

Do note that you have the option to add your aging parents to your family floater plan. However, Mehta suggested buying separate standalone insurance for parents.

“That is because they should have a sum assured that they can exclusively use and often the products for seniors are different from those below 65 years,” he added. Moreover, you can also claim a deduction of up to Rs 25,000 for health insurance of self/family and Rs 50,000 under Section 80D of the Income-tax Act, 1961, for senior citizen parents while filing income tax returns.