1/4th buy travel insurance 30 days prior to trip: How to pick the right one

Only 25 per cent of Indians going abroad buy travel insurance well in advance while making travel arrangements; a large majority wait until the last 3 days to buy it, according to a survey conducted by Policybazaar.

While people nowadays understand the importance of buying travel insurance, they are still not aware of the lesser-known benefits of buying one, besides coverage for baggage loss, flight cancellation and medical emergencies. This could also be because, predominantly, a major chunk of Indian travellers go to Asian countries, and they don’t need to present their policy copy until the day of the trip.

As of July 2023, over 38 per cent of the people travelling abroad planned their trip for more than 15 days, mostly for European countries, followed by 26 per cent planning to stay for 7-10 days.

Seven out of 10 people understand the importance of having an adequate sum insured while travelling abroad, choosing over $100,000 as sum insured. The rest of them choose almost half of it, which is the minimum coverage you can opt for, according to the survey.

The trend of vacationing abroad has reached the pre-pandemic level, with over 97 per cent of people currently travelling outside the country for leisure. Thailand continues to be the most preferred Asian travel destination for Indians. Vietnam and Indonesia are also emerging as hot travel destinations after the pandemic.

“Just like you plan your accommodation, flights and itinerary, deciding on a comprehensive travel insurance policy that can protect and safeguard you against common travel inconveniences is essential, allowing you to peacefully enjoy your trip with family. Before buying a travel insurance policy, you must check all the inclusions and exclusions carefully. You must ensure that the most common and basic benefits like coverage for Covid-19, medical emergencies, trip cancellation and curtailment, baggage loss and passport theft, etc, are covered under your policy,” said Manas Kapoor, Product Head – Travel Insurance, Policybazaar.com.

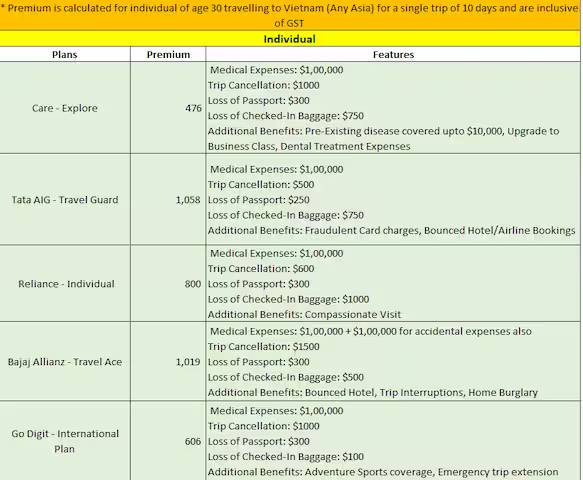

Some other popular benefits that travellers should opt for are coverage for pre-existing diseases or illnesses, OPD coverage, trip extensions, personal accident cover, home burglary insurance and multi-trip insurance or frequent flyers plan. Policybazaar has curated a list of travel insurance policies available for overseas trips to Asia that you can opt for

How to choose the right travel insurance policy when travelling overseas:

Rahul Meena Mishra, co-founder & director, Policy Ensure, explains how to choose and decide on your travel policy:

• Assess your needs: Consider your travel destination, duration, and activities you plan to engage in. Determine the level of coverage you require for medical emergencies, trip cancellation or interruption, baggage loss, and personal liability.

• Check coverage limits: Review the coverage limits provided by different insurance policies. Ensure they meet your specific requirements, especially for medical expenses, emergency medical evacuation, and trip cancellation costs.

• Understand exclusions: Read the policy exclusions carefully. Be aware of situations or activities that may not be covered, such as pre-existing medical conditions, adventure sports, or acts of terrorism. If you need coverage for any excluded items, look for policies that offer optional add-ons or specialised coverage.

• Medical coverage: Pay close attention to the medical coverage offered by the policy. Check if it includes emergency medical treatment, hospitalisation, ambulance services, and repatriation of remains. Ensure the coverage limits are sufficient for the destination you’re visiting, as healthcare costs can vary widely across countries.

• Trip cancellation and interruption: If your trip is expensive or involves non-refundable bookings, consider a policy that provides comprehensive trip cancellation and interruption coverage. This will protect you financially in case unforeseen circumstances force you to cancel or cut short your trip.

• Baggage and personal belongings: Look for a policy that offers coverage for lost, stolen, or damaged baggage and personal belongings. Check the coverage limits and any sub-limits for valuable items like electronics or jewellery. Also, verify if the policy covers delayed baggage and provides reimbursement for essential items during the delay

• Compare prices and reviews: Obtain quotes from multiple insurance providers and compare the prices against the coverage offered. However, remember that the cheapest policy may not always provide the best coverage or customer service. Read reviews and ratings of the insurance company to gauge its reputation and customer satisfaction level.

• Pre-existing medical conditions: If you have pre-existing medical conditions, ensure that the policy covers them or offers a waiver for pre-existing conditions. Some policies may require you to declare your medical conditions upfront or undergo a medical examination.

• Travel assistance services: Consider the additional services provided by the insurance company, such as 24×7 emergency assistance, travel concierge services, or language translation support. These can be valuable during emergencies or if you need assistance while travelling.

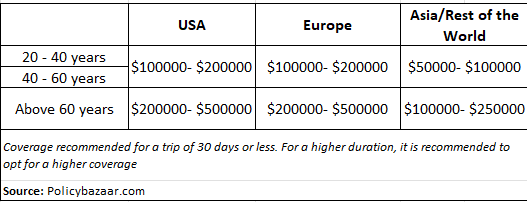

What’s the ideal option and cover? Overview of the right coverage based on age and destination, according to policybazaar:

Destination-specific coverage: Different countries may have unique risks and healthcare systems. Research the healthcare facilities, quality of care, and associated costs in the countries you intend to visit.

Schengen Visa requirements: If you’re travelling to Schengen countries in Europe, it is mandatory to buy travel insurance that meets the minimum coverage requirements (30,000 euros) specified by the Schengen visa authorities. Make sure your chosen policy fulfils these requirements to avoid any issues with your visa application.

High-cost destinations: Some countries, such as the United States, Canada, or countries in Western Europe, have higher healthcare costs. If you plan to visit these destinations, ensure your travel insurance policy offers sufficient coverage for medical expenses to avoid potential financial burdens.

Adventure sports and activities: If you’re planning to engage in adventure sports or activities like skiing, scuba diving, or bungee jumping, check if your policy covers such activities. Some policies may have exclusions or require additional coverage for high-risk activities.

Political unrest and natural disasters: If you’re travelling to regions with a history of political unrest or natural disasters, consider a policy that includes coverage for trip cancellation, trip interruption, or evacuation due to these unforeseen events.

Duration of travel: If you’re a frequent traveller or planning a long-term trip, look for policies that offer coverage for extended periods. Some policies may have limitations on the maximum duration of coverage, so choose one that aligns with your travel plans.

Family coverage: If you’re travelling with family members, especially children or elderly individuals, ensure the policy provides suitable coverage for their specific needs. This may include coverage for pediatric care, pre-existing conditions, or medical evacuation for older travellers.

Policy extensions and renewals: If you’re planning to extend your trip or have flexible travel plans, check if your insurance policy allows for extensions or renewals while you’re abroad. It’s important to have continuous coverage throughout your entire trip.

“To maximise the protection, ensure coverage for checked-in baggage loss, trip delay/cancellation, and loss of passport. An emergency cash assistance feature in the policy can be useful if you are mugged or robbed on foreign soil and left without travel funds. It will also be prudent to have a personal liability feature that covers legal liability to a third party resulting in injury, damage to property, and even death, during your trip,” said Rakesh Jain, CEO of Reliance General Insurance.